The following table compares the three unique core strategies Radius Capital Management offers. Within each of the three strategies, we offer various risk levels to match the particular risk tolerance and time horizon of our clients. During our initial and follow-up discussions with you, we analyze these and other factors to determine which portfolio best meets your needs.

| Radius Strategy | Index Strategy | Balanced Risk Strategy | |

|---|---|---|---|

| Investment Style | Market-Correlated Momentum | Market-Correlated Momentum | Multi-Asset Risk Parity |

| Active vs. Passive | Active | Passive | Semi-Passive |

| Style Description | Seeks to invest in the mutual funds that have the best risk-adjusted returns over the past year. | Invests in broad-based passive market indices and holds them for at least one year to avoid short-term capital gains. | Seeks to balance the portfolio risk exposure to generate more stable portfolio returns in all market/economic environments. |

| Fund Types | Primarily passive index ETFs | Primarily passive index ETFs | Primarily passive index ETFs |

| Average Fund Turnover | Nine months to one year | A minimum of one year | Buy and Hold with portfolio rebalance 1-2 times per year |

| Tax Efficiency | Fair (many capital gains are short-term) | Good (all capital gains are long-term) | Moderate (short-term gains, but on a smaller percentage of the portfolio) |

| Stock Fund Categories | Large/Mid/Small Value, Blend & Growth, Diversified Intl. and Global | Large/Mid/Small Value, Blend & Growth | Large Blend, Small Blend, |

| Bond Fund Categories | Long-Term and Intermediate-Term Corporate, Blend, and Government High Yield, Intl. and Infl.-Protected | Long-Term and Intermediate-Term Corporate, Blend, and Government High Yield, Intl. and Infl.-Protected | Long Term Government, Government Inflation Protected, Emerging Market, |

| "Hard Asset" Categories | None | None | Gold, Commodities, Real Estate |

| Invested Since | January 2001 | July 2014 | April 2015 |

The following graph shows where the three Radius investment strategies fall in terms of investment style (active vs. passive) and correlation to the market (S&P 500).

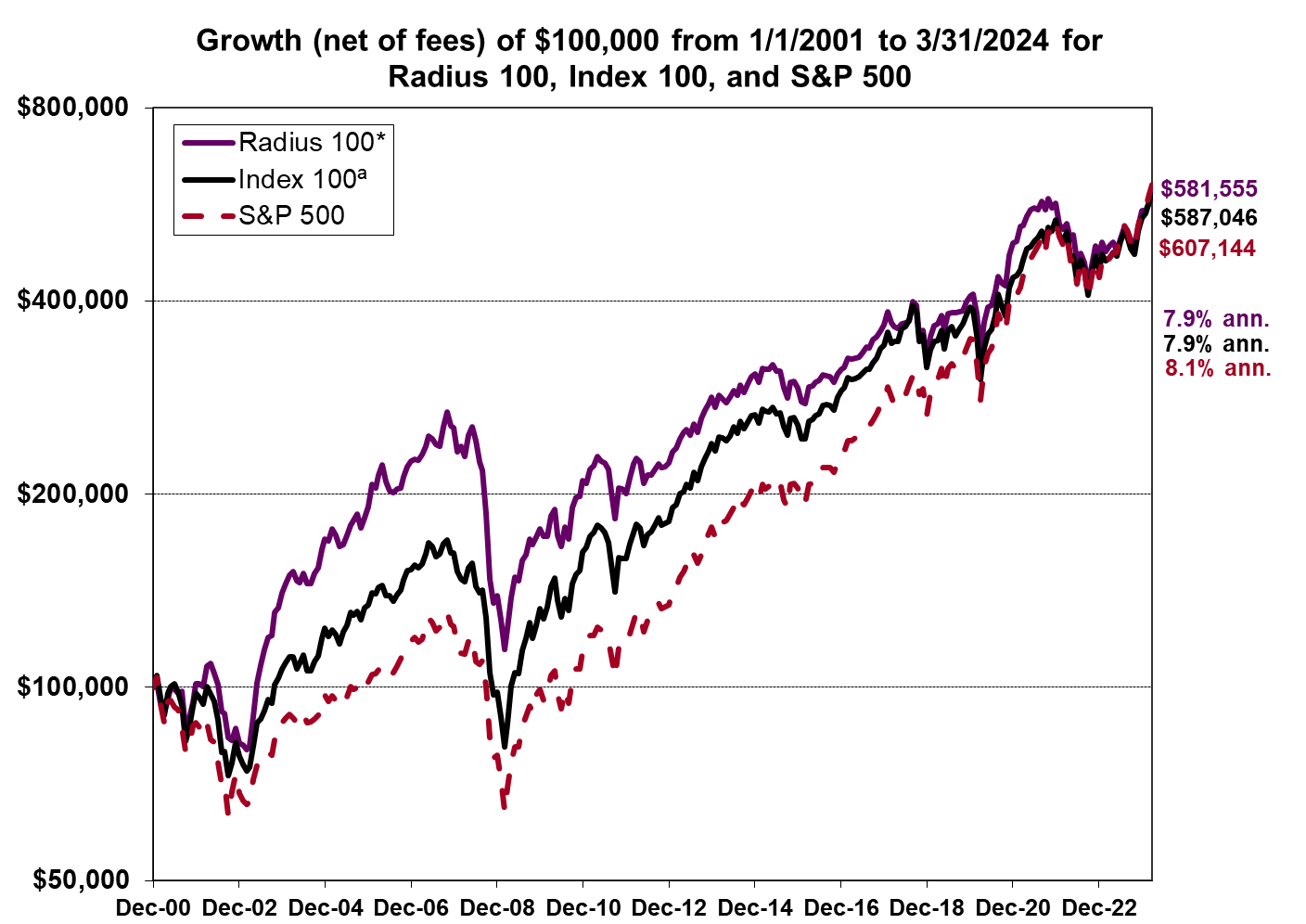

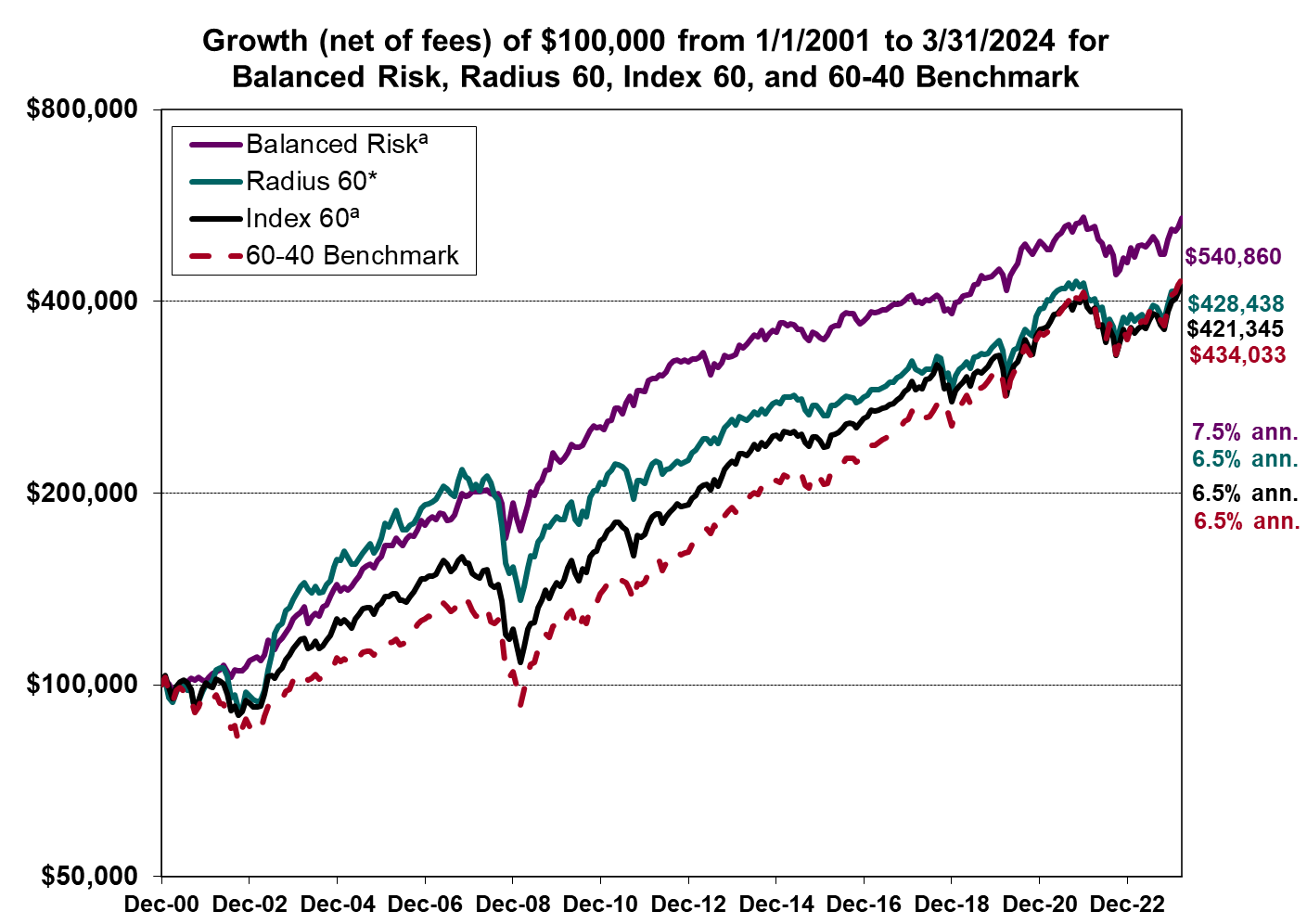

The graph below illustrates how $100,000 invested in each strategy would have performed compared to their benchmarks since 1/1/2001.

Comments/Disclosures on Performance Numbers:

Past performance is no guarantee of future results. It should not be assumed that investment decisions made in the future will be profitable or will equal the performance of the portfolios shown above.

Total return numbers for the Radius 100 portfolio reflect the (unaudited) performance of actual portfolios that have been invested since 1/1/2001.

Performance numbers for the Index 100 prior to 8/2014 and the Balanced Risk Strategy prior to 4/2015 are back-tested and do not represent the actual performance of portfolios managed by Radius.

All performance numbers include dividends and capital gains and are reported net of all transaction costs and management fees.